10 extraordinary economic collapse in the history of

Since ancient times, and to this day we step on the same rake, often reaping dismal results. In this list, in chronological order, are the most interesting economic fall in the history of civilization. We may be able to feel more confident on the background of the mistakes of our predecessors.

The destruction of the economy of the Roman Diocletian (fourth century AD)

When Diocletian became emperor, the Roman Empire was in decline. The economy has been undermined by a succession of costly wars and building projects of previous rulers. Rome was on the brink of disaster. In order to deal with the depreciation of the currency, Diocletian conducted a monetary reform. Many countries throughout history have made the same economic adventure - to artificially increase the cost of money. However, Diocletian went completely the other way. He began to produce coins with a gold content of coins above face value, reducing thus the value of gold. In response to this deranged idea of most citizens become to melt the coin, because he turned out to be more expensive alloy. As a result, the empire a new wave of inflation. Thus Diocletian complicated the situation by setting a price ceiling for most commodities as kontrinflyatsionnoy measures.

Diocletian's economic transformation has been so controversial that many Roman provinces refused to follow the decrees of the emperor. The situation deteriorated to the point that Diocletian was the first Roman emperor to voluntarily left the throne. In addition to the extra damage the already weakened Roman economy, its gross miscalculations in the economic policies put in weakening the unity of the empire and the emperor status.

The conspiracy of the Pazzi and the collapse of the banking house of the Medici (1470th)

The Medici family played a leading role in the Italian Renaissance. Representatives of this type of controlled policy of Florence, who served as Pope and was patronized by Leonardo da Vinci. Family Welfare was the source of the international banking system, based Medici at the end of the fourteenth century. Under the direction of Cosimo de 'Medici bank expanded rapidly, and by the time of the death of Cosimo found himself in a difficult position. At a time when the financial possibilities of the Medici were at the limit, other bankers family - the Pazzi and Salviati decided to take away their power over Florence. April 26, 1478 an attempt was made in one of the Florentine church of two members of the Medici family. The plan was implemented only partially, but still Medici regained full control of the situation. Assets of the bank usually provides only reserves by ten per cent, which was very risky.

Due to the Pazzi conspiracy and various wars, bank largely lost competitiveness and came close to bankruptcy. As a result of Lorenzo de 'Medici he was forced to impose the citizens of Florence extortionate taxes, ostensibly for military purposes. Finally, in 1494 as a result of corruption, bad investments and mismanagement, the bank went bankrupt. At the same time the economy of Florence was struck a multimillion-dollar damage, and its complete restoration took years. Given that the Bank has appropriated funds charitable foundation, provides the dowry of girls from impoverished families and belonged to the King of France - Charles VII of, the crisis had international significance.

Inflation in Spain (XVII century)

When Columbus discovered America, Spain began an active search for gold in a new continent. With a rich American mineral resource base, Spain for decades been one of the richest countries in the world, sprawling into a mighty empire. The second half of the sixteenth century, Spanish increased production volumes to a hitherto unprecedented scale. However, contrary to expectations, the flow of minerals was nearly swept Spain itself. Svezheotchekanennogo excessive amount of gold and silver in Europe has led to the depreciation of money and hyperinflation in all European countries. Together with the ongoing military campaigns Spain, inflation has caused irreparable damage to the country's economy. Rather than wallow in luxury, Spain has been a series of defaults. These economic squabbles led to the decline of the Spanish empire and the exaltation of the British.

"pork money" Bermuda (1616-1624 years)

In the seventeenth and eighteenth centuries the British Empire expanded due to the activities of several large trading companies. With some of them were colonized and Bermuda. Immediately after the formation of the settlement, the colonists began to work for the benefit of companies. At the same time employees in lieu of wages, provides original loan (the same practiced coal mining companies in the nineteenth century). Daniel Tucker, received the post of Governor of Bermuda, corporate loans canceled and put into circulation its own copper coins.

Since this monetary system had no other economic foundation than ambition Tucker colonists overthrew the governor. Full economic catastrophe was avoided only because Bermuda is an isolated island. In the absence of a monetary system, the colonists were forced to use instead of tobacco currency.

Trolley and swing (1621)

When a country borrows heavily to finance the war, nothing good is not the end. In the seventeenth century, the tax system was not very effective, so new money to the Thirty Years' War of the Holy Roman Empire was forced to get by minting more coins. In this old coins withdrawn from circulation, melted and then added into the melt cheap metals. The name of the crisis was due to the measuring instruments used for the accounting of coins before melting. Coins of low esteem were put into circulation in the adjacent areas to prevent damage to the economy of the empire. In the end, these coins are returned to the territory of the Holy Roman Empire in the form of taxes and duties. Found out about the financial maneuver of the authorities, the people expressed dissatisfaction, the soldiers refused to accept coins as payment, began to appear leaflets calling for insurrection. Money eventually depreciated so much that the children played with coins on the street. The subsequent rise in prices has undermined the economies of many subjects of the empire.

tulip crisis in the Netherlands (1636-1637 years)

This may be the most unusual episode in our list. Tyulpanomaniya considered the first documented economic bubble in history. Appearing in the Netherlands at the beginning of the XVII century, the tulip immediately gained popularity. Dutch citizens have become obsessed with the desire to purchase fresh tulips. Since tulips are growing only at certain times of the year, so the Dutch created the futures market. That is when the tulips can not be purchased, they are willing to buy the rights to the tulip bulbs, which were to appear in the future.

Soon, thanks to the activity of speculators, prices in the futures market soared. At the peak of the hype the price of some bulbs reached the amount of average earnings in the Netherlands for ten years. The bubble burst in 1637, and the cost of the bulbs slipped to the original level. As in the stock market crash of 2008, the funds have evaporated investors. Wonderful flower collapse let the wind set of states, and a fair number of investors had to put teeth on the shelf.

South Sea Bubble (1719-1720 years)

South Sea Bubble shows us what can happen when the speculators in their actions neglected several important limitations. In the early eighteenth century, the British economy suffered from the excessive spending of the government. As a result, British investors seriously interested in stories about the rich deposits of gold in America. To gain access to this wealth has been generated the South Sea Company, which the British monarchy granted the exclusive right to trade in the Americas. South America belonged to Spain, respectively, granted rights were worthless, but, despite this, poured investment into the Company. Despite the obvious obstacles to the success of the enterprise, investment reached hardly any annual British GDP. On the British stock exchange just took off. The company even contract many buy out the government's public debt. Confidence was so high that the finance minister himself has invested in the company a few hundred thousand pounds. At the end of 1720 the total value of shares of the Company of the South Seas was about 37 million pounds. Spain, of course, refused to grant British entrepreneurs their gold, and the stock price collapsed. Strike shook the British economy, leaving many investors with empty pockets. Britain's economy has lost a whole generation of overnight riches.

Mississipsky bubble (1716-1720 years)

United Kingdom was not the only country to have suffered from the mistakes of speculators in the first quarter of the eighteenth century. After the death of Louis XIV, the French economy has been completely depleted by continuous wars that are waged across Europe Sun King. In the treasurer did not even have enough gold to mint new coins. John Law - economist at the French government proposed to create a bank that would print paper money. The government has printed so much money that their number is five times higher than France's welfare.

To resolve the problem and to save the economy from destruction, Lo announced if the new French colony - Louisiana is very rich in gold, which provides excellent opportunities for investors. He hoped that the government will succeed thanks to investments to improve their financial situation and solve the problem of useless notes. In 1720, when the promised mountains of gold in Louisiana did not appear, the bubble burst and shares devalued investors. There was a panic withdrawal of bank deposits, the currency depreciated Luo twice, and destructive inflation hit the French economy.

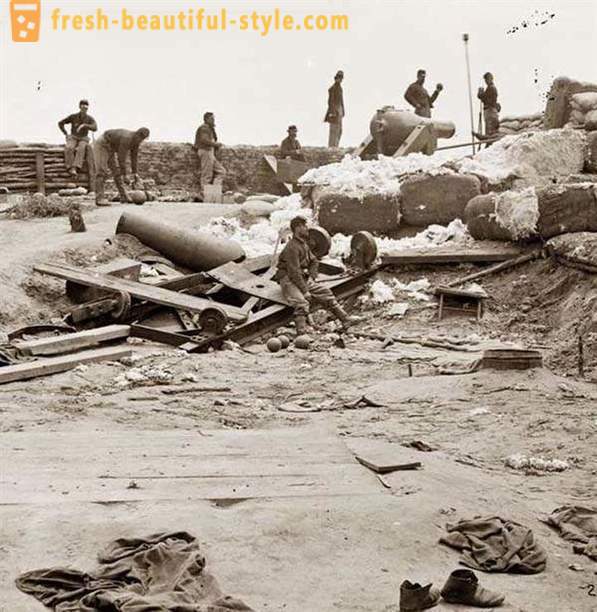

The Confederation of destroying their own economy (1860)

During the Civil War in America, the most important purpose of the Confederation was to provide diplomatic recognition on the part of European countries. To gain recognition, they decided to stop the export of cotton to England and France, knowing the important role played in the cotton economies of these countries. It should be noted that the Union blocked Confederate ports, but the Confederates managed fairly easy to break through the blockade until near the end of the war.

Coupled with the Union blockade, the failure to export cotton has led to almost complete nullification of the Confederation of trade profits. These two factors have led to runaway inflation, which is fully depreciated currency Confederation. After the Civil War, the South was an economy in ruins.

The crisis of the railways and silver in America (1893)

Before the Great Depression, the worst US economic crisis was considered the panic of 1893. Because the most important mode of transportation in the United States began to railways, speculators actively invested in them. Many railways were too stretched and income from their operation are not able to cover the costs of maintenance of infrastructure. In 1893, the giant railroad company - "Philadelphia and Reading" filed for bankruptcy.

At that time, as railway companies began to fill the cones, the silver market is experiencing a real shock. In the 1880s several silver mines were opened. As a result of increased production of silver, its cost has decreased significantly. The US government has not come up with the best anti-crisis as buying silver in the hope of artificially raising the cost. However, once I stopped buying, the crisis reached its peak. Settled as a result of economic depression lasted until the early twentieth century, killing 16,000 and leaving companies without work up 17-19 percent of the population in the most acute period.