7 7 best and worst corporate acquisitions GOOGLE

This company is changing the world in which we live. Their business started in a college dormitory, and now Google has more than 70 offices in 40 countries and headquartered in Mountain View in Silicon Valley called the Googleplex. Google known for innovative approaches to working with clients and investors. Their corporate acquisitions sometimes super-successful, sometimes - a failure. "We are still far from ideal, but actively moving towards it," - say they are modest about himself.

From 2001 to 2014, Google Inc. has acquired 141 company. purchases peaked in 2010-2011 (53 acquired companies). 11 of them purchased for the Google X project, are engaged in technologies of the future (cars without a driver, glasses augmented reality, etc...) Experts believe that most Google currently interested in robots - the number of robotics technology in the list of companies they bought just rolls (eg , Schaft - humanoid robot, Industrial Perception - computer vision, Redwood Robotics - robotic arms, Meka Robotics - a developer of robots, Holomoni - robotic wheels, etc.)...

Google says of himself:. "For us to be the best - it is not the destination, but only the beginning of the path we have set ourselves the goal of which can not yet reach, but we know that in an effort to them, will do more than expected.. " Unofficial motto of the company, invented by Google engineer Paul Buchheit: "Do not be evil!" (Do not be evil).

In 2015, Larry Page said that Google will be transformed into a holding company under the name Alphabet. Due to this, a newly created company, to make an independent subsidiary of the company, will release Google Inc. from excessive load, reduce the number of managers and reduce the level of bureaucracy within the company. Not so long ago, it was put into operation a subsidiary of Google company called Life Sciences, which operates as a separate branch, creating a useful innovation for the health sector. Upon completion of the transformation, as part of Alphabet are 9 different organizations, and each of them has its own budget, and the direction of the CEO. Power vertical built more clearly, and these organizations are not subject to the president of the holding company Google, as well as the head of Alphabet. Each branch develops its direction and is subject to your supervisor. For example, control the structure of Google X continues Sergey Brin.

By 2001, the name "google" has entered into everyday speech, resulting in "google" a verb has been added to the Merriam Webster Collegiate Dictionary and the Oxford English Dictionary (meaning "to use the Google search engine to find information on the Internet").

These guys really are changing the world - even the language that we speak. Zaguglit, if you do not believe me!

14

Nest (successful investments)

Nest is a revolutionary thermal home mode control system. The goal - to save money on energy consumption. Google showed great interest in the products, developments and skills Nest three hundred of its employees. Founded in May 2010, the company Nest Labs set itself the task of improving the living space. It produces technologically advanced Nest Learning Thermostat and Nest Protect. Thermostat is endowed with a complex technology to maintain optimum climatic conditions in the house: analyzes the actions of households determines when they leave home, adapts to their preferences and the rhythm of life in order to save costs. In this case smoke detectors jointly analyzed hazard location and alert the homeowner through built-in speakers or smartphone possibility of ignition, and during a critical situation - and fire departments.

Nest will operate under the Alphabet, the parent company for all of Google's projects. After the announcement of the purchase of Nest for $ 3, 2 billion (the second largest after the absorption of Motorola Mobility in 2011 for $ 12, 5 billion), Google's market capitalization rose by $ 9 billion, reaching about $ 384 billion. Since the launch of unit-risk investments in 2009, only three times the Google acquired the company in which Google Ventures invested: Makani Power, Milk and quite insignificant Bufferbox, became the fourth Nest. Interestingly, the KPCB company, which owned the largest proportion of shares in the Nest (about 60%), received as a result of the transaction 20 times the compensation of their previous investments.

13. Zagato (successful investments)

Google acquired the company Zagat - one of the most prominent names on the restaurant review market. Zagat is known for its small printed guide with reviews and recommendations of restaurants around the world. In 2011, Google bought Zagat little more than $ 150 million for the integration of restaurant reviews from Google Maps, and other services. Having acquired Zagat Survey, Google released in fundamentally new markets segments. He was the creator of the content, and the publisher of printed products.

The main purpose of the purchase - the development of Google local products, for example, the same Google Places. Buying the Zagat - one of the most printed in the US restaurant guides and city guides - meant that thanks to a deal Google has received valuable content about restaurants, hotels, bars and nightclubs, which he was able to integrate its online services.

Products Zagat Survey has not been disseminated on the Internet. The company was making only paper guides, which published ratings of hotels, restaurants and information about discounts and special offers. Books were branded red cover, and information they collected more than 350 thousand. Authors around the world. Guides published huge numbers, such as a guide to New York out of 600 thousand. Copies a year. Now, information on gourmet restaurants in over 100 countries from Zagat critics in geolocation services integrated into Google's online corporation. Bravo Google! ... you have almost hopelessly outdated service and made it a winner!

12. Android (successful investments)

Android - an operating system for smartphones, Internet tablets, e-books, digital players, watches, game consoles, netbooks, smartbooks, the Google glasses, TVs and other devices. In the future, support vehicles and household robots. It based on the Linux kernel and its own implementation of the Java Virtual Machine from Google. Initially developed by Android, Inc., which was then bought Google. Google subsequently initiated the establishment of the alliance Open Handset Alliance (OHA), which is now engaged in the support and development of the platform. Android allows you to create Java-based applications, controlling the device via Google-designed library.

For a paltry $ 50 million, Google Corporation has received an amazing space for maneuver and was able to skillfully integrate the mobile phone market. Android, the operating system works with many Google products and acts as a portal. In 2005, Google has been at the forefront of technology, having made this acquisition, when there was a boom in the smartphone market. Today, Android and Apple, each has its share in the market of smart devices. This investment has begun numerous possibilities and create additional markets for Google in a key moment in the history of technology. Excellent choice, Google! We were able to look into the future and address the innovation leader!

11. doubleclick (successful investments)

In the online advertising world, everything happens quickly, and Google would have a dominant position in this market. Having made the purchase in 2007 of the company Double Click company for a fairly low price (only $ 3, 1 billion), Google instantly found himself at the head of the list of the leaders of Internet advertising. They got their own software and all business relations established at this point doubleclick. This, incidentally, one of the oldest advertising Internet companies, and among their customers are the real monsters - great company, from Visa to Microsoft. Approach to advertising from Google and DoubleClick are different, and they had a lot to learn from each other. In Google - context-sensitive keyword advertising in the extensive network of sites, but the main thing - that the advertising is displayed at the request of its hugely popular search engine. Unlike Google, DoubleClick ads are targeted not so much on the site-site, as for the user. With the help of, the cookies have, it collects information about the user transitions within sites and between sites, the number of impressions of the same banner to one user, information about the user. Moreover, DoubleClick allows you to target ads on the information collected about the user - up to the local time of the day! Combining these mechanisms defined the future direction of the Internet advertising market. Google very wisely decided to invest more than $ 3 billion in this area that in the long term is a great investment!

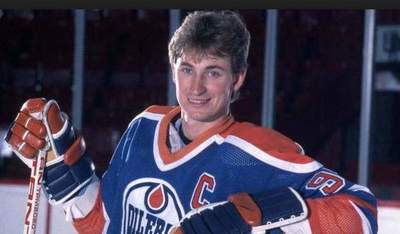

10. Waze (successful investments)

Waze - a navigation service that helps to navigate on the road, taking into account traffic jams, accidents and other complications. In 2013, Google decided that it is necessary to GPS users to more actively interact with the system. In a culture that values the cooperation of users, $ 933 million seemed necessary investments to achieve this goal by buying Waze.

Waze has developed a wonderful way that allows GPS users to provide updated traffic information. Google quickly grasped the essence of this cool ideas and competently splice it with its own navigation system.

Now the truth has become easier than ever to get somewhere optimal route and find out whether the road works are, whether the road is open, and so on. It provides alternative routes to save time, circling the cork, and travel has never been so comfortable - and all thanks to Google and Waze. The Internet giant is ahead of the world in relation to maps and navigation.

9. SkyBox Imaging (successful investments)

Microsatellite company Skybox using satellites specially designed not only receives images of the surface of the Earth with a granularity of 90 cm per pixel, but also allows you to receive HD-video in almost real time. Skybox was bought by Google in 2014 for ridiculous $ 500 million. Representatives of Google officially announced that purchased Skybox to improve Google Maps and its other services:. "Moons will help provide accurate and current picture for our cards Over time, we also hope that the team and the Skybox technology helps in providing access to the Internet in remote places and disaster areas - areas in which Google is interested for a long time. "

Among other activities Skybox - monitoring of agricultural land in order to identify pests, modeling insurance claims taking into account the assets, information about the state of oil storage, tracking of cargo ships and containers and analyze logistics supply chains.

Now you know exactly how Google gets clear, detailed pictures for your cards. Google would not only dominate the market maps and navigation, but also to provide the best product without any complaints. With this acquisition, Google has received some amazing technology.

With the integration of these technologies to Google-Maps, Google continues to stay one step ahead of all its competitors. They made a rebranding SkyBox - now it's a new company called Terra Bella - and launched a number of satellites to make more innovation in the use of images for the purpose of data collection. When Google receives innovative ideas, for them, it seems, nothing is impossible.

8. The U-Tube (successful investments)

YouTube name nowadays became a household name. Thanks to this service to the whole world declared itself a lot of talented people, including, for example, pop sensation Justin Bieber! This is a great way to share your thoughts and talents with the world, without leaving your home. In 2006, Google realized that sharing video will be the next big breakthrough in the world. And in fact, they were right when they made this deal for $ 1, 65 billion - they again made history. They make the story more accurately. Being an ideal way to share videos with the world, and to bring people into a kind of social network where others want to see and be seen, YouTube has become an indispensable marketing tool for businessmen, politicians, and educational institutions. The search engine built on this platform, became widespread, second in popularity only to the original Google search engine.

7. Frommer's Travel (failure)

Unlike other technology giants, Google is not afraid to spend billions who receives from his lucrative business. Sometimes Google does logical investment, such as buying or YouTube Android and others, which you have read above. But it does happen and mistakes, and quite large.

Strange to say, this project could develop in different ways. In 2012, Google acquired brand Frommers Travel for $ 22 million It was quite a small acquisition for Google, but oddly enough, just nine months after the purchase, they sold the company -. And back to Arthur Frommer. Upon return of the company there was a serious drain subscribers in social networks ... Google has reserved all the followers of social media Frommers Travel and simply renamed account.

According to experts, the acquisition of Frommers Travel could allow Google to significantly expand its business in the online services market has to offer and to compete with such popular online services like Yelp Inc and TripAdvisor. After all resources for tourists - the fastest growing segment of the market. And Google is actively working in this direction. Now the company has a search online reservation system and ITA Software, on the basis of its service Google Flights is created.

6. Jaiku (failure)

Remember Jaiku? This Finnish service for microblogging, in his development, he at some point ahead of Twitter. To compete with Twitter, Google bought Jaiku. And then I closed it. Of course, now there is no way to find out would be a Jaiku as successful as Twitter or not. Even when Twitter was not as popular, somewhere in 2008, when there would be a good alternative, maybe people en masse would have moved to another service. Today, Twitter is worth about $ 4 billion So, Jaiku or Twitter would be exceeded, or buy Google for $ 2 billion -.. It's a big mistake. By the way, pessimists warned users not to rush to move from Twitter to Jaiku - they were confident that the service will share the fate Jotspot and Dodgeball (two startups were acquired by Google, but did not receive much attention from the new owner). They say Google is just too long swinging and lost a lot of time with this service. Later, the corporation transferred the project on Google App Engine, and opened the source code of a site. October 14, 2011, Google announced the planned closure of the Jaiku service from 15 January 2012. And on November 29 a group of ex-service user creates Jaikuarchive.com - The Jaiku Presence archive "to preserve an important part of the digital heritage."

5. Dodgeball (failure)

Dodgeball was an interesting combination of a social network gaming service. Google has launched the process of merging and acquisitions, and acquired the company in 2005, hoping to turn it into another big social network. But, unfortunately, it did not work. The founders of the firm abandoned, and the team set about creating Foursquare ... that, in fact, is the same as that of Dodgeball.

Service to determine where Dodgeball position was popular even before Foursquare. Google bought it - and Google has closed. By 2009, Google has practically ceased to develop Dodgeball. They tried several times to revive him, but did not get. Perhaps, as with Jaiku, it was an issue of some delays and delays, or maybe there were too many other pressing projects. Regardless of whether it happened for whatever reason, Dodgeball ended most epic failure in the history of Google.

4. Motorola Mobility (failure)

Google has spent more than $ 12 billion for the takeover of Motorola Mobility, which is the third largest manufacturer of Android-smartphone. It would seem that a great opportunity for Google, to introduce new hardware and create an amazing device. Unfortunately, the innovation does not happen and the products that they produced, were suddenly considered substandard.

Google bought Motorola Mobility for $ 12, 5 billion, and a few years later sold for $ 2, 9 billion in the Lenovo, which received the brand Motorola and smartphone portfolio (Moto X, Moto G and Droid Ultra). A significant part of the patent, including the current application on the Motorola patents were from Google. Chinese company Lenovo has received a license to these patents and other intellectual property. In fact, the reason that the Alliance did not work out, is not entirely clear. Many thought that it was a bad idea from the start. Let's just say - buy Motorola has become a terrible failure.

3. Aardvark (failure)

Google paid $ 50 million for the Aardvark, a question and answer service, which had a significant number of followers, and a very cool concept. It was a well-developed idea, and it quickly caught Google. This happened at a time when Google bought a lot of small startup companies.

And so, in 2010, Google acquired Aardvark - a search service that allows you to ask questions and compare the answers of people versed in any subject. Aardvark was very popular among mobile users at a time. But the service was shut down a year later, and some useful points moved to Google+.

When Google has cut some of the costs of acquisition of the project, Aardvark was one of them. Although some part of the integrated Aardvark for Google+, by and large, the project turned out to be just blurred. Very sorry that some interesting ideas dissolve into giant companies.

2. JotSpot (failure)

JotSpot was acquired by Google in October 2006 - is the platform, or more precisely, a web-based application that was renamed Google Sites. The application offers as a free service for individuals who wish to create their own Web sites Wiki type. The problem lies in the fact that they were not very popular, and they were quickly ahead of the competition. Over time, as Google has adopted the concept of the Sites Google, and after all the updates, JotSpot became totally recognizable and now it looks very different.

Google Sites is still not very popular, but it seems that Google is not in a particularly saddened. When buying small companies like JotSpot, Google simply absorbs everything, sometimes without having a clue what to do with them later. While Google's appetite has always been greater than the size of the stomach, they often have to pay for such failures in innovation.

1. dMarc Broadcasting (failure)

In 2006, Google acquired DMARC Broadcasting for the tidy sum of $ 102 million DMARC -. It is a promotional platform for radio-broadcasting, where Google is going to give a boost in audio advertising purposes. The venture with an investment of $ 102 million in this sector in advertising could bring billions to Google the world, but instead, the money just flowed, as the direction is not fully covered not in 2009.

Due to the fact that the success of the automated radio advertising depends on the interaction with existing radio stations were vibrations from the station in relation to a bold new concept of Google. Google and the radio - they are like oil and water (in many respects) - just do not mix, and Google was just not avoid its own stigmata. Horrible, it was worth $ 102 million - to find out what Google did a web company.